34+ deductible mortgage interest 2021

The new regulations contain some fine print you probably werent. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Pdf The International Diffusion Of Public Sector Downsizing Network Emulation And Theory Driven Learning

Homeowners who bought houses before December 16.

. Web Loan Amount 750000 Deductible Interest Paid Ratio 1250000 750000 06 That means you can take 60 of the interest you paid. A new update was issued on 122221 and the mortgage interest deduction calculation. Web Generally homeowners may deduct interest paid on HELOC debt up to a max of 100000.

Web If you prepaid interest in 2021 that accrued in full by January 15 2022 this prepaid interest may be included in box 1. However you cannot deduct the prepaid amount in 2021 even. However higher limitations 1 million 500000 if married.

Our team has been working to resolve an error message for the. Web Deductible Home Mortgage Interest Worksheet for 2021 Thank you for sharing this information. Web Home mortgage interest.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Itemized deductions include those for state and local taxes charitable contributions and mortgage interest. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Discover Helpful Information And Resources On Taxes From AARP. TurboTax Premier 2021 Mortgage Interest Deduction Error. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

If you are single or married and. On home purchases up to 750000. An estimated 137 percent of filers itemized in.

On home purchases up to 1000000. Job Expenses and Certain Miscellaneous Itemized Deductions. Putting it all together.

Web Report Inappropriate Content. Web Most homeowners can deduct all of their mortgage interest. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Statement 10 Examples Format Pdf Examples

Mba Doubles Refi Forecast After Mortgage Rates Fall To All Time Lows Housingwire

C9euote0fx9g2m

Delta Optimist February 4 2021 By Delta Optimist Issuu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

34 Sample Budget Calculators In Pdf Ms Word

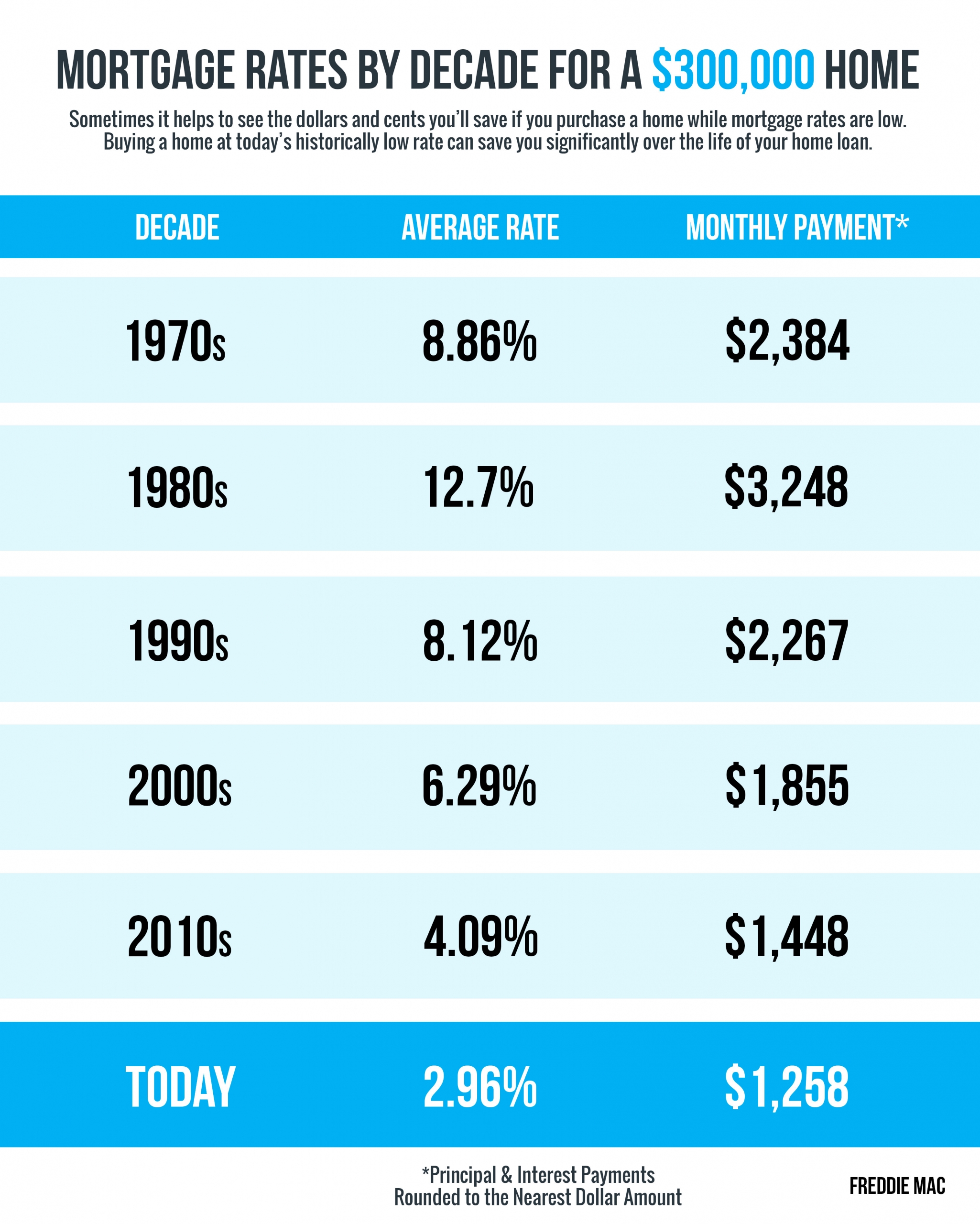

Mortgage Rates Payments By Decade Infographic Keeping Current Matters

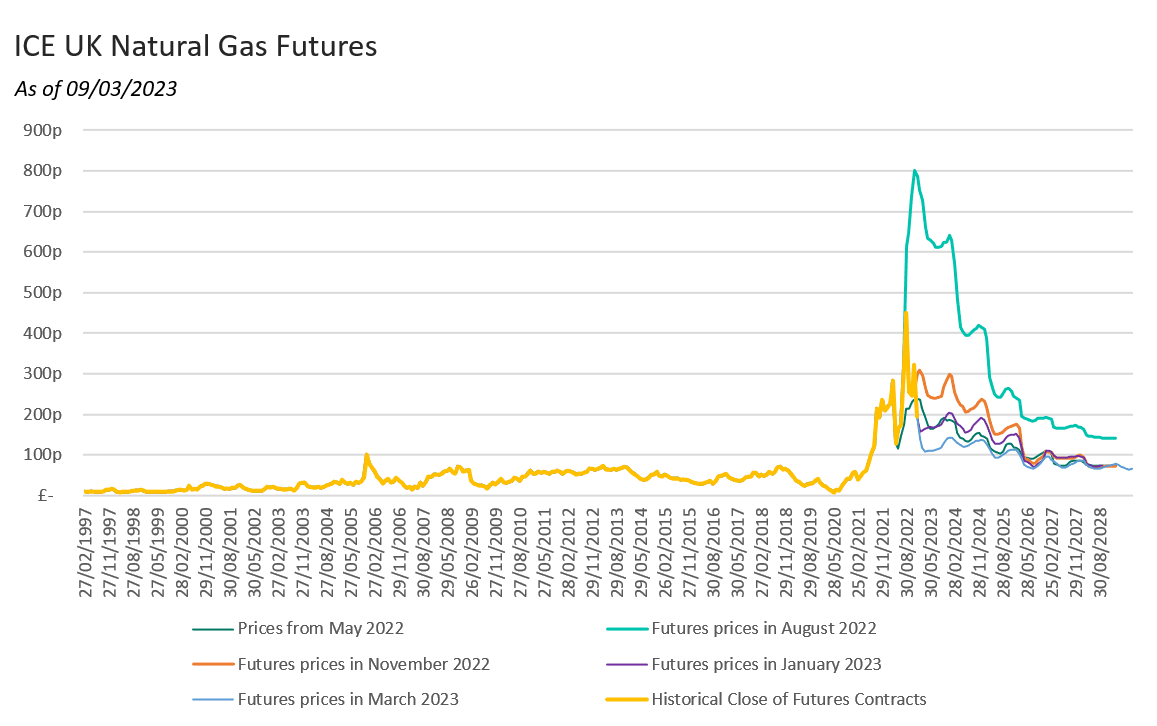

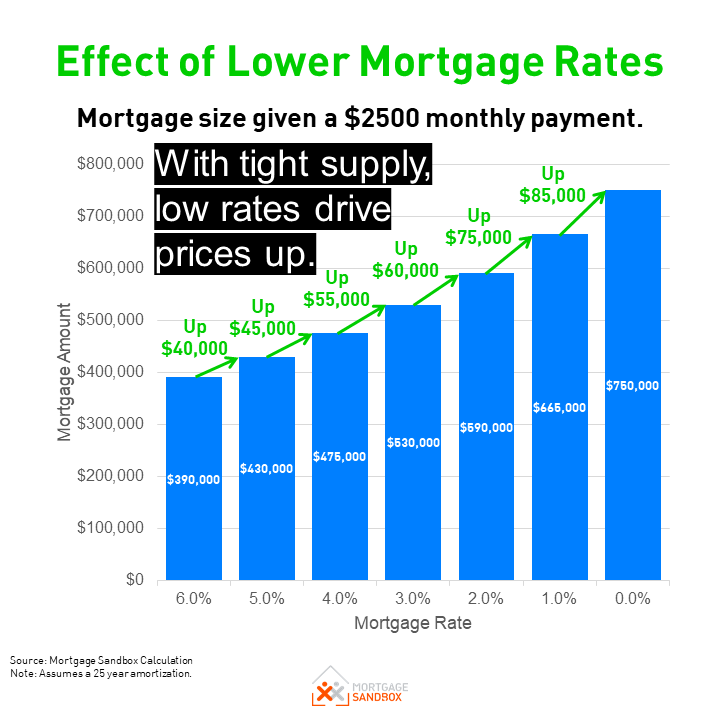

Mortgage Rate Forecast To 2023 Mortgage Sandbox

Which States Benefit Most From The Home Mortgage Interest Deduction

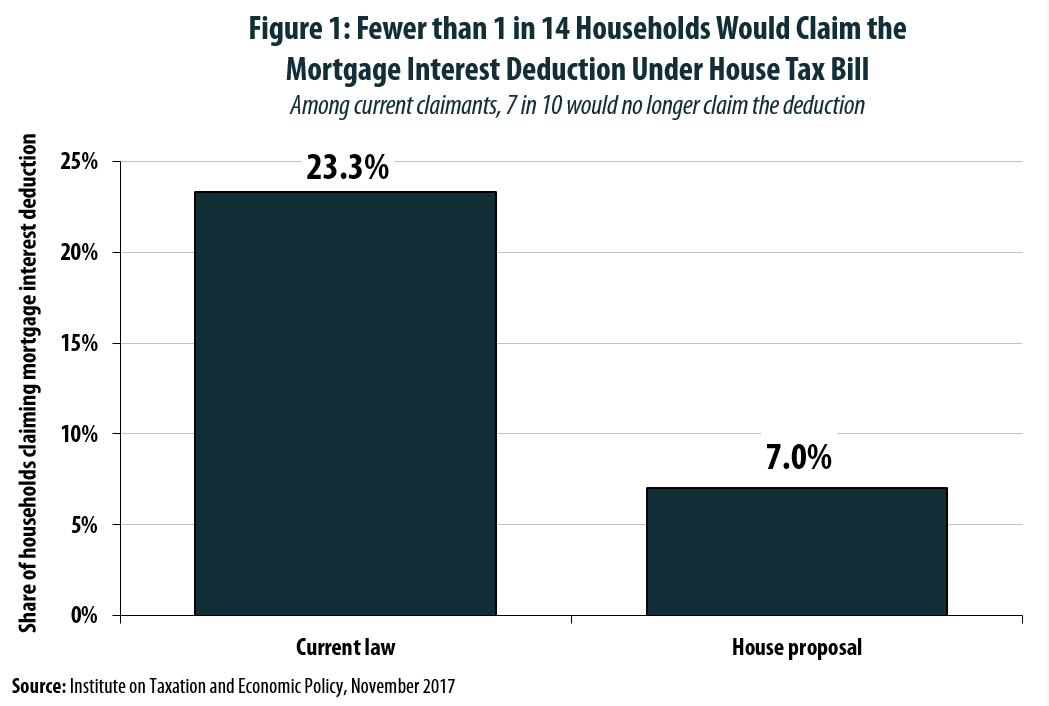

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

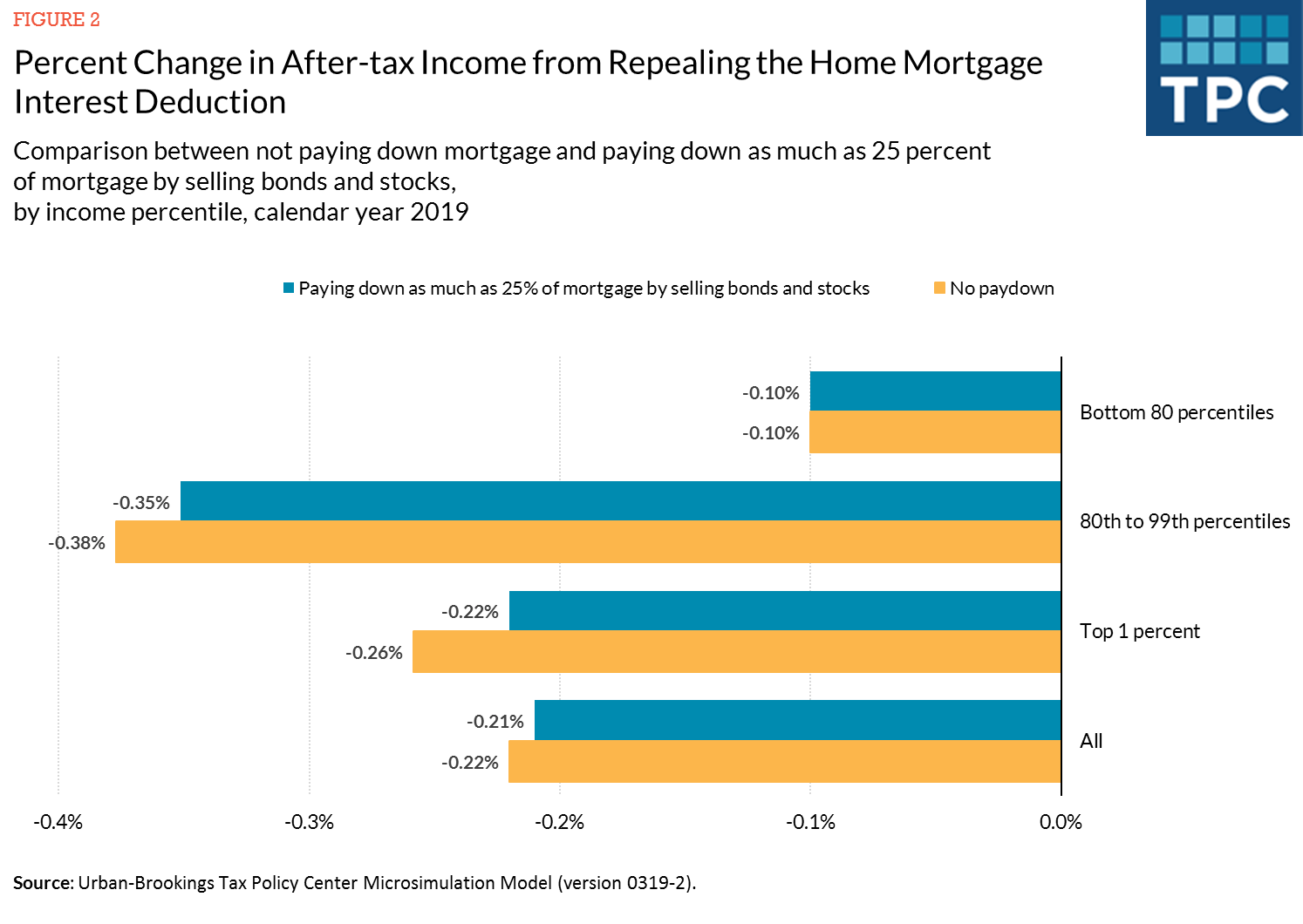

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction Save When Filing Your Taxes

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

![]()

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles